How to Develop an App Like Dave: A Complete Guide

Keyur Patel

September 12, 2025

8 min

Built to provide financial peace to users before the paycheck arrives, advance cash apps like Dave are gaining popularity in leaps and bounds. Money lending apps like Dave have emerged as a quick solution for people looking for advanced cash or short-term loans with low interest rates. The ease and reassurance they provide make them especially attractive to users who need fast financial solutions.

Well, people will soon forget the idea of visiting banks and borrowing loans. What do you think? So, are you intrigued by the idea of developing a payday loan app like Dave? Read through this app to know the market statistics of the cash advance app and how you can build a competitive cash advance app like MoneyLion.

What is a Cash Advance App? An Overview of Dave App:

Cash advance apps are convenient lending app solutions that provide a pre-approved amount of advance payments to the users. The payment is usually interest-free, for the short term, and can easily be accessed to cover any emergency expenditure. This provides quick relief in times of financial urgency

Usually, the cash advance app functions in the following way:

- The user downloads the application;

- They fill in the bank details for verification and register themselves on the app.

- Whenever needed, the user applies for an instant cash advance.

- The application analyzes the requirement, checks for eligibility, and approves the request.

- Users can put in a request at any point in time, and return to the system within the defined period.

- Many cash advance apps also charge a small fee over the borrowed amount, but this is usually very minimal compared to the interest users would pay if borrowed from the banks.

The idea helps users bridge the financial gaps that they might face during the month’s end or periods of high spending.

Dave app functions on the same concept. The cash advance app was created in 2017 by Mark Cuban and Capital One Financial Corp as the primary investor.

Dave is one of the most popular fintech apps that stands out in its user-friendly approach— charging no fees for overdrafts or low balances. For users who rely on small, frequent loans, the application allows them to build a positive credit history over a period. Further, this credit score can be used to avail multiple benefits.

Also Read : Top 10 Cash Advance Apps Like Dave/ MoneyLion Alternatives

The market size of the money apps like Dave:

- The mobile banking market is estimated to reach $1824.7 million in 2026.

- As per the market data, there are nearly 57 million m-banking users in the United States.

- Users commonly borrow an amount between 100% and 200%.

- Nearly 33% of Americans confirmed using Cash Advance Apps.

- According to a report, the United States money lending app is registered to a CAGR of 2%.

The figures show a drastic inclination of interest amongst users for money lending apps. And this has paved the way for business owners like you to build a convenient cash advance application like Dave.

From the lender’s perspective: Such platforms also help payday lenders lend their money to users who need money immediately.

However, it is important to note that there is a difference between payday loan apps and cash advance apps. Let us look at the difference.

People often use payday loans and cash advance apps interchangeably. However, there is a difference between the two.

Payday loans apps are short-term loans that provide a small amount under $500 to the users for 14 days, typically. It usually refers to the process of payday checks that are given twice a month or once, and the user is expected to repay it as soon as they receive the salary.

Payday loan apps charge high fees, some of them even calculate daily interest. It is often referred to as money lending apps

Cash Advance Apps are also short-period apps, but they do not charge any interest or fees for a predetermined period. Here it goes without saying that the user has to return the advance as soon as they receive the payday deposit.

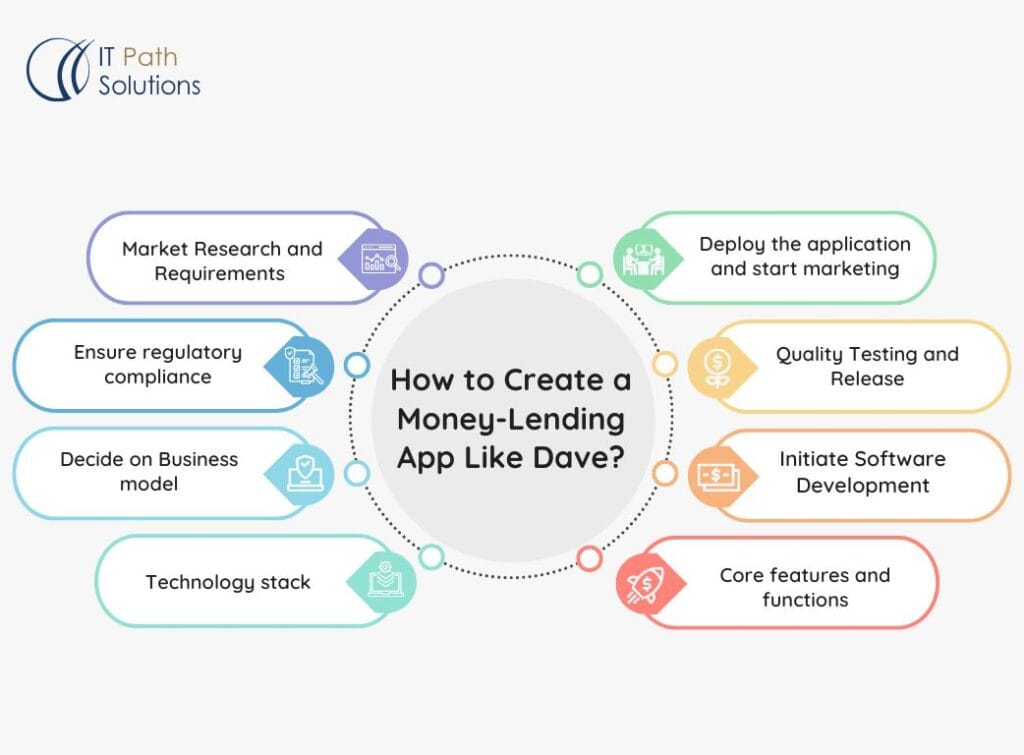

How to Create a Money-Lending App Like Dave?

Here are a few steps that you can explore to develop money-lending apps like Dave.

Market Research and Requirements Understanding;

The first step to successful application development starts with market research. Start by analyzing the existing market demands and examine the requirements of the users. Study existing competitors, their offerings, strengths, and where they are falling short. A comprehensive analysis of the fintech landscape will help you see through the idea and let you understand how you can pass through the rivals.

Ensure regulatory compliance:

Compliance with regulatory standards is critical. Hire legal help to learn the details about financial regulations, Payment Card Industry Data Security Standards, and data protection laws like GDPR and CCPA. This will help avoid any legal complications for the present and future.

Decide on Business model:

The digital finance market is massive and dozens of apps can give you strong competition. However, each of them comes with any one of the limitations which you can analyze and cover up in your advance application idea.

This research will also help you understand various revenue models adopted by the competitors. A few common business models cash advance apps adopt are:

- Subscription fees

- Transaction fees;

- Paid partnerships and advertising;

- A minimal platform registration fee;

Whichever monetization strategy you choose, should be sustainable and profitable.

Technology stack:

Selecting the right combination of technology stack is extremely critical. The first thing that you need to decide is whether you want a native application or a cross-platform application.

Look out for an app development partner, check their portfolio, and analyze their skills to make sure that they can deliver the project as per your expectations. While selecting, do consider the development cost and the promised time to market and make sure it aligns with your project timelines.

Core features and functions:

The research process will give you a pool of feature options that you might think of integrating into the application. However, do not overpopulate the cash advance apps with features that might become redundant later.

Why? The whole motive is to make the application UI intuitive and not flooded with redundant features.

Partner with an experienced website development company that can help you integrate advanced technologies such as AI/ML into the platform to make the experience more engaging.

Initiate Software Development:

Once you have set the vision of how you want your application to be, you can start the development with your website development partner. Ensure that the development company follows the Agile process and standard practices to develop the platform.

Quality Testing and Release:

No application is released perfectly unless thoroughly tested. The development partner checks each and every functionality to make sure that the application remains protected against breaches and security vulnerabilities.

Deploy the application and start marketing:

Once the application is thoroughly tested, prepare it for deployment. Make a plan in a way that the application is made available to the audience in an interesting way. A well-designed roadmap would be helpful for a successful launch of the website application.

What are the must-have features in a Money Lending application?

Here is the list of must-have features for your money lending application like Dave.

| Features | Functions |

| User profile set up and log in | Integrate user authentication for registration so that you only have authentic app users. |

| Cash advance disbursal | Let users initiate money access requests by verifying their bank account details. |

| Repayment Settings | Allow users to decide the repayment terms for the advance cash |

| Notifications | Send timely notifications to the users regarding the repayment status or any new offers that are available on the platform. |

| Card management | Let users activate or deactivate an existing debit card or credit card in use. |

| Loan Calculator | Integrate a loan calculator functionality using which users can check the interest amount or approved sums within the application itself. |

| Security features | Financial applications like Dave apps deal with a lot of sensitive financial information. The platform should ensure that it is rightly protected against any data theft or breach. |

What is the cost of Payday loans application development? How IT Path solutions can help you minimize the cost and time to market?

If you are building a Payday loans application from scratch, it usually costs between $25,000 to $50,000 with basic features integration. If you go on with the advancements and customization, the cost may increase.

Now, when it comes to ITPath Solutions, we have a huge team and extensive experience in developing state-of-the-art financial solutions. With our thorough research approach and delivery, we are one of the trusted partners for financial app development.

Our target is to speed up the development and cut down the cost without compromising on quality. Our developer hiring rates are very competitive, with promised quality. You can get in touch with us to discuss your project idea further. Thank you for reading this!

Keyur Patel

Co-Founder

Keyur Patel is the director at IT Path Solutions, where he helps businesses develop scalable applications. With his extensive experience and visionary approach, he leads the team to create futuristic solutions. Keyur Patel has exceptional leadership skills and technical expertise in Node.js, .Net, React.js, AI/ML, and PHP frameworks. His dedication to driving digital transformation makes him an invaluable asset to the company.

Get in Touch

Search

Blog Categories