Home

»Blog Insights

»Fintech App Development in 2025: Complete Guide to Building Secure & Scalable Apps

Fintech App Development in 2025: Complete Guide to Building Secure & Scalable Apps

Keyur Patel

September 12, 2025

13 min

Have you read about the fincrime cases of the following cases:

-

The Danske Bank case: Money Laundering;

-

The Equifax Data breach: Cybercrime;

-

The Martha Stewart Case: Insider Trading;

-

Shell Companies: Money Laundering;

-

BCCI Case: Money Laundering.

Each of these incidents exposed loopholes in financial systems, leading to losses of billions of dollars. The biggest lesson here is clear: we need stronger compliance, smarter systems, and constant vigilance to prevent such risks. This is exactly where fintech app development comes into play.

In the post-COVID era, as people shifted to mobile-first lifestyles, the demand for mobile banking, digital payments, and investment platforms skyrocketed. The global fintech market is projected to reach $305 billion by 2025, and mobile payments alone are forecasted to exceed $12.6 trillion by 2027. This rapid growth reflects how businesses and startups are exploring how to create a fintech app or how to develop a fintech app that ensures both innovation and compliance.

From personal finance apps and neobanking platforms to InsurTech solutions and stock market investment apps, users now expect seamless digital experiences. That’s why entrepreneurs and enterprises are focusing on building a fintech app with robust security, real-time data integration, and a user-first approach. If you’re wondering how to develop fintech app solutions that can stand out in this competitive market, this blog will guide you through everything you need to know about fintech app development, including the types, features, costs, and future opportunities.

Starting with,

What is Fintech App Development?

Fintech app development refers to the process of strategizing, designing, and launching mobile or web applications that deliver financial technology solutions. If you’re exploring how to create a fintech app, the journey typically involves using advanced technologies like AI/ML, Blockchain, IoT, and Big Data to streamline and innovate financial services.

Whether you are building a fintech app from scratch or researching how to develop a fintech app, having the right development partner is crucial. A skilled team can align with your business goals, ensuring that every stage of the project is executed effectively.

If you’re ready to explore how to develop fintech app solutions tailored to your needs, get in touch with our experts to discuss your requirements.

Understanding the Fintech Industry:

Fintech first emerged in the 1990s with the rise of online banking, paving the way for today’s digital finance ecosystem. Over the years, fintech app development has transformed how people manage money, make payments, and invest. For anyone exploring how to create a fintech app or curious about how to develop a fintech app, it’s important to understand the industry’s evolution and the apps that shaped it.

Here are a few fintech apps that gained traction and influenced the way entrepreneurs started building a fintech app for different niches:

| Year | App |

| 1998 | PayPal |

| 2007 | iPhone laid the stage for mobile banking apps |

| 2008 | Introduction to Bitcoins |

| 2010 | Crowdfunding platforms like Lending Club and Kickstarter rise |

| 2015 | Revolut and Stripe |

| 2017 | Open Banking Regulations in Europe |

| 2020 | COVID-19 transforms the financial industry |

| 2021 | BNPL app like Perpay and AfterPay |

| 2023 | AI and other technology integration |

Today, we have reached a stage where it is difficult to get away without a fintech application. So, why are you waiting? If you have a brilliant fintech app development idea, come and discuss it with us.

Benefits of Developing a Fintech App

If you’re considering fintech app development, here are some compelling benefits that highlight why building a fintech app can transform both customer experience and business operations:

1. Accessibility and Convenience

With a fintech app, users can access financial services anytime, anywhere. From seamless payments to global transactions, fintech applications break geographical barriers and make banking services more inclusive and user-friendly.

2. Increased Efficiency

Developing a fintech app helps automate tedious manual processes, reducing paperwork and administrative tasks. This not only saves time for financial institutions but also allows employees to focus on more strategic, high-value activities—boosting overall operational efficiency.

3. Enhanced Security

Modern fintech apps integrate advanced technologies such as blockchain, data encryption, and biometric authentication. These features safeguard sensitive financial transactions, ensuring users can trust the platform for secure money management.

4. Data-Driven Insights

Fintech applications collect and analyze user data (while adhering to compliance standards) to uncover financial behaviors and patterns. Businesses can use these insights to deliver personalized services, refine offerings, and make data-backed decisions that enhance customer satisfaction.

5. Continuous Innovation

The fintech sector is rapidly evolving, and developing a fintech app positions you at the forefront of this innovation. From AI-powered financial assistants to smart investment tools, the rising demand for digital solutions creates opportunities for new players to enter and grow in the market.

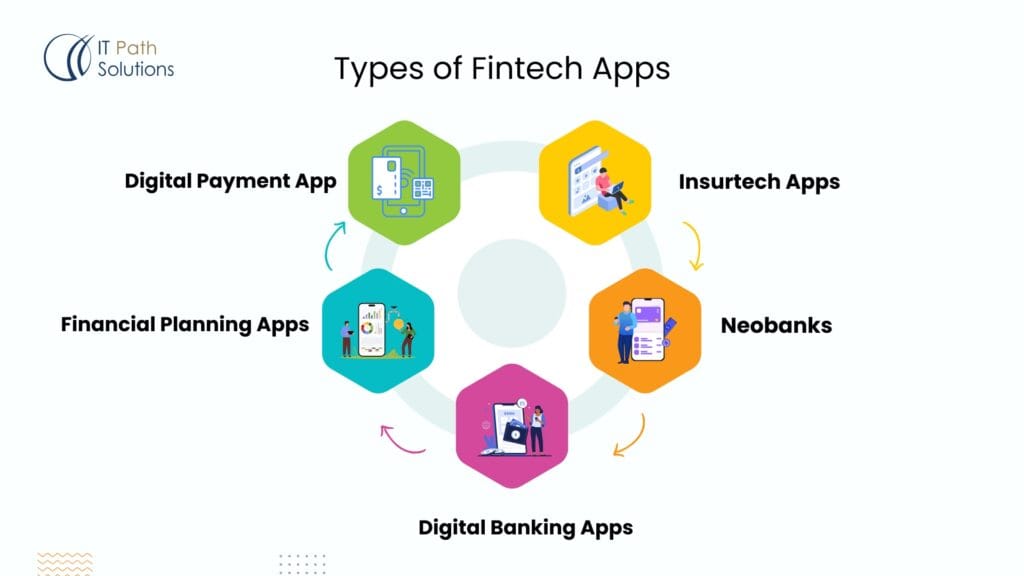

Types of Fintech Apps:

Fintech today encompasses a broad spectrum of operations. From managing investments to streamlining payments, there’s already an application for virtually every financial need. Here are a few fintech app types that you can explore for application development.

Digital payment app:

Digital payment apps have become a great substitute for cash. People are moving towards online payment systems, or currencies to initiate any purchase. The benefits of developing a digital payment app are:

- People can pay at their convenience using their mobiles;

- Facilitates cross-border transactions

- It has simplified checkout processes for customers;

- Uses encryption and tokenization to secure a transaction

Insurtech apps:

Insurtech apps refer to the process of using technology for insurance processing. Such apps speed up the following processes.

- Claim processing;

- Information analysis;

- Risk assessment;

- Increased reach;

- Automate multiple tasks;

Financial planning apps:

Financial planning apps are usually capable of integrating multiple bank accounts. Users can manage their accounts, credit cards, investments, etc using the same. It lets users set up a portfolio and monitor performance using financial planning apps.

Neobanks:

Neobanks are fully digital financial institutions that provide users with 24/7 accessibility and seamless online banking experiences. Unlike traditional digital banking solutions tied to physical banks, neobanks operate independently and offer a wide range of benefits tailored to modern user needs:

- Neobanks promises faster development;

- Intuitive and user-friendly interfaces;

- Lower fees and better exchange rates;

- Neobanks might also offer early access to direct deposits;

- It offers molecular control over card usage and various security features;

Digital banking apps:

The most common type of finance application that you can develop is a digital banking app. Digital banking apps are capable of managing accounts, tracking expenses, and offering security features.

What Are the Must Have Features of Fintech Applications?

No matter what type of fintech solution you’re building whether it’s a mobile banking app, digital wallet, investment platform, or Insurtech app there are certain core features every fintech app development project must include. These features not only enhance user experience but also ensure security, scalability, and compliance. If you’re exploring how to create a fintech app or planning on building a fintech app for your business, here are the must-have features that should be part of your development roadmap.

-

User registration and authentication:

Secure the user signup process by implementing OAuth 2.0 or other encryption methods or hashing. You can also integrate biometric authentication for quicker authentication.

-

Account management:

Let users manage their accounts, check balances, and perform the basic operations involved.

-

Payment gateway integration:

Allow users to transfer money seamlessly and securely between different accounts. Integrate reliable payment gateways like PayPal or Stripe to ensure smooth and hassle-free transactions. To enhance security, incorporate advanced measures such as tokenization and 3D Secure 2.0 protocols.

-

Security features:

Fintech application’s success heavily relies on the security features you integrate into the app. As an application owner, you must implement end-to-end encryption using AES-256, two-factor authentication, and fraud detection capabilities in the application.

-

Dashboard:

A comprehensive intuitive financial dashboard provides a visual representation of all the activities performed by individuals. The dashboard provides insights into users’ spending, upcoming bills, savings, portfolios, etc.

-

Push notifications:

The Fintech app should keep the users updated about their account activities. It should send them alerts on any unauthorized activity detection for them to take action. To ensure this, you can implement Firebase Cloud Messaging, silent push for background updates, and actionable buttons.

-

Customer support:

The application needs to provide in-app assistance to the users. To ensure that support happens seamlessly, you can integrate chatbots plugins NLP, or provide an email id for quick communication.

-

Voice assistance:

You can integrate voice assistants like Siri or Google Assistant using which customers can quickly access the services.

-

Multi-currency support:

The fintech app facilitates transactions in multiple currencies. By implementing multi-currency support, you enable customers to seamlessly transact in their preferred currencies without any hassle.

-

Gamification:

Acquiring customers is one thing, but engaging them to stay on the app is another. You can implement gamification features to compel users to stay for it.

-

AI/ML integration:

Integrate AI/ML capabilities in the application to tailor the application’s offerings.

What is the mobile app development process for fintech app development?

Fintech app development requires a very strategic app development process that can cover multiple things, from features to compliance and maintenance. It is better to go with a mobile app development partner that offers comprehensive suites of fintech app development services.

At IT Path Solutions, we follow a strategic app development process that comprises the following steps. Read the blog for more details.

Technology Stack for Fintech App Development:

| Native app development | – iOS: Objective, CSwift, Apple XCode, iOS SDK

– Android-: Java, Kotlin, Android studio, Android SDK |

| API & Integrations | Open Banking APIs, Third-party payment processors |

| Cloud | AWS, Microsoft Azure, Google Cloud Platform |

| Database | PostgreSQL, MySQL, MongoDB |

| Cross-platform app development | React Native, C# |

| Hybrid app development | HTML 5, PhoneGap |

| Other advanced technologies | AI/ML, Data Analytics, Blockchain, IoT, Node.js, C++ |

How much is the cost of fintech app development?

The cost of developing a fintech application varies drastically depending upon the features you choose, the technology you select, and the integrations you initiate.

You should discuss your application’s offerings with your prospective app development partner.

If IT Path Solutions is to give you an estimate, the cost of app development with basic features is $30,000-$50,000. However, as you move forward with more customization, the pricing goes on increasing. Get in touch with us to discuss your application idea.

Fintech + Generative AI: The Next Big Shift

Generative AI (GenAI) is no longer just a buzzword it’s reshaping the fintech industry in 2025. From fraud detection to hyper-personalized financial advice, fintech app development is increasingly powered by AI-driven intelligence. According to Netguru, 88% of fintech startups now leverage AI, and it’s expected to save the global financial industry over $120 billion annually.

How Generative AI is Transforming Fintech Apps

-

Personalized Financial Advisors – Fintech apps can now act like digital wealth managers, offering tailored investment strategies and budgeting tips through GenAI chatbots.

-

Fraud Detection & Risk Management – AI models analyze millions of transactions in real-time, identifying suspicious activity far faster than humans.

-

Customer Support Automation – AI-powered assistants resolve up to 78% of queries without human intervention, improving efficiency and reducing costs.

-

Regulatory Compliance – GenAI helps financial institutions monitor transactions and generate compliance reports, lowering the risk of penalties.

Why It Matters for Building a Fintech App

If you’re exploring how to develop a fintech app, integrating Generative AI is no longer optional it’s a competitive necessity. Users expect smarter, faster, and more personalized experiences. By embedding GenAI into your app, you’re not just enhancing customer engagement but also future-proofing against fraud, regulatory risks, and customer churn.

Monetization Strategies for Fintech Apps

One of the most overlooked aspects of fintech app development is revenue generation. While building a fintech app requires significant investment, the good news is that there are multiple monetization models available. Understanding these models can help startups and enterprises plan how to create a fintech app that not only delivers value to users but also generates sustainable profits.

Proven Monetization Models in Fintech

-

Transaction Fees – Apps like PayPal or Stripe charge a small fee on every transaction. This model works best for payment gateways, digital wallets, and money transfer apps.

-

Subscription Plans – Premium features such as advanced analytics, robo-advisory, or exclusive investment insights can be offered under a monthly or annual plan.

-

Freemium to Premium Model – Basic features are free, but users can upgrade for enhanced security, faster transactions, or personalized financial tools.

-

Lending & Interest Margins – Peer-to-peer lending and neobank apps often earn revenue through loan interest or small margins on deposits.

-

Partnerships & Referrals – Many apps monetize through strategic partnerships with banks, insurance companies, or investment platforms. For example, offering insurance add-ons directly within a fintech app.

-

Data-Driven Insights (Ethical Use) – With consent, anonymized user data can be leveraged for market analysis, helping businesses create new revenue streams.

Why Monetization Matters in Fintech App Development

If you are exploring how to develop a fintech app, choosing the right monetization strategy is as important as the features you add. Monetization models should align with user trust, compliance, and scalability. A well-defined revenue plan not only attracts investors but also ensures your app remains competitive in the fast-growing fintech market, which is projected to reach $305 billion by 2025.

Parting Thoughts:

Fintech app development will solve critical business challenges by increasing security, automating processes, and enhancing overall customer satisfaction. It’s time to harness the power of advanced technologies and excel with your fintech app development vision. IT Path Solutions has expertise in developing fintech applications that are scalable, reliable, secure, and tailored to your specific business needs. Contact us to discuss more about your project.

FAQs:

1. How long does it take to develop a fintech app?

On average, a basic fintech app can be built in 3–6 months, while more complex solutions with advanced integrations may take 9–12 months or longer.

2. What are the essential features of a fintech app?

Must-have features include user authentication (MFA, biometrics), real-time notifications, payment integration, transaction history, fraud detection, secure APIs, and data encryption.

3. Which technologies are used in fintech app development?

Fintech apps often rely on AI, blockchain, cloud computing, big data analytics, and secure APIs. Popular programming languages include Python, Java, Kotlin, Swift, and JavaScript.

4. What security measures should a fintech app have?

Critical security measures include end-to-end encryption, biometric login, multi-factor authentication, fraud detection, and compliance with PCI-DSS, KYC/AML, and GDPR standards.

5. How do you ensure compliance when building a fintech app?

Compliance depends on the market, but typically includes PCI-DSS (payments), KYC/AML (anti-money laundering), GDPR/CCPA (data privacy), and SOC 2 for data handling and security audits.

Keyur Patel

Co-Founder

Keyur Patel is the director at IT Path Solutions, where he helps businesses develop scalable applications. With his extensive experience and visionary approach, he leads the team to create futuristic solutions. Keyur Patel has exceptional leadership skills and technical expertise in Node.js, .Net, React.js, AI/ML, and PHP frameworks. His dedication to driving digital transformation makes him an invaluable asset to the company.

Get in Touch

Search

Blog Categories