How To Start a Neobank App Development From The Scratch?

Keyur Patel

September 12, 2025

8 min

Neobanks have challenged traditional banks’ functioning. What once looked like a three-day task with conventional banking is now transformed into a few-minute task with a Neobank application. As a new player in the fintech app development industry, neobanks are revolutionizing financial services by offering unmatched convenience without the need for a physical presence, setting them apart from conventional banks.

In this article, we will understand the concept of neobank application, how it differs from traditional bank concepts, and what changes it brings to the table.

A Small Backstory About The Origin of Neo-bank Apps:

The idea of neobanking application was conceptualized in 2015 when the open banking concept became popular. With open banking, traditional banks and various other financial institutions can securely share data and manage financial flow.

During the same period, Revolut, Monzo, and Atom Bank were released. This completely changed the way how financial services are handled and managed using apps. Revolut and Monzo’s apps laid the foundation for neo-banking compelling banking industry experts to make a quick shift to mobile apps.

Neobanks offers a wide range of banking services including account opening, lending, saving accounts, payment processing, etc. However, all of these can be done by using only web or mobile applications.

The Future Of Neo-banking:

- According to Grand View Research, the neobank market had a worth of $47.39 billion in 2021 on a global scale, and it’s projected to have a compound annual growth rate (CAGR) of 53.4% from 2022 to 2030.

- In 2023, the global neobanking market boasted a valuation of $98.4 billion.

- By 2032, experts predict that the global neobanking market will reach an astonishing $5070.8 billion, maintaining an impressive CAGR of 54.09%.

These numbers indicate the rising demand for neobanks and we believe the timings are just right if you initiate neobank app development right now.

Opportunity scope: There are just 272 neobanks in the world, so get ready and jump into the world of mobile banking.

Difference Between Neobank App and Digital Bank App:

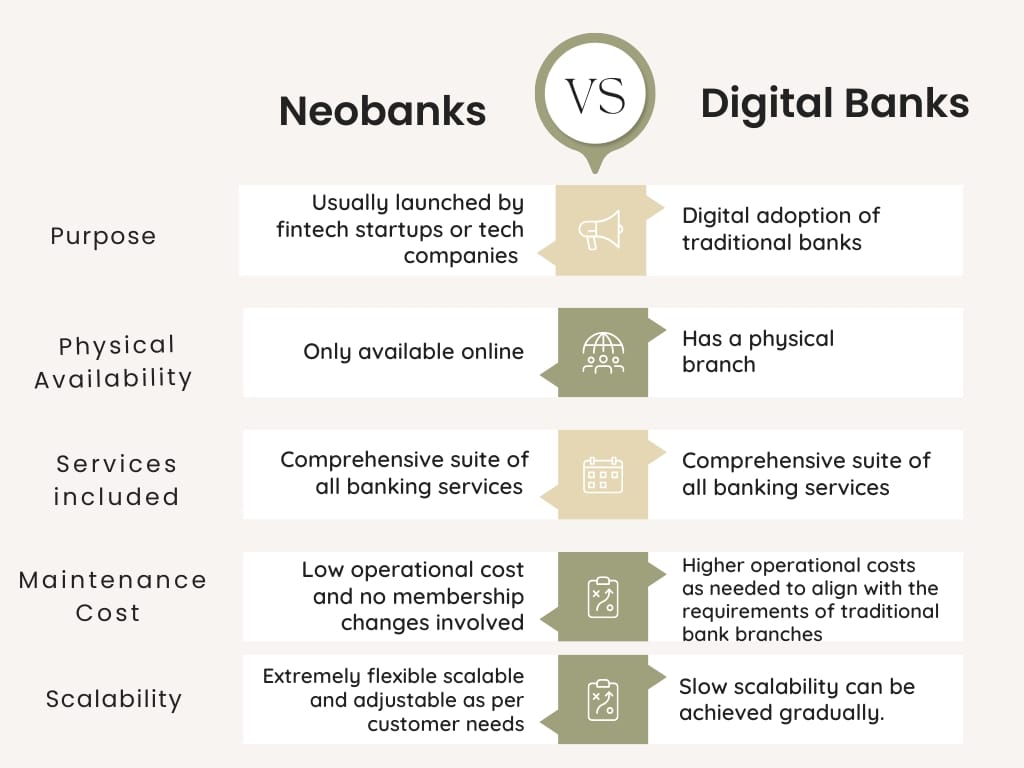

Let’s learn the difference between Neobanks, Digital banks, and Traditional bank services.

The above information highlights the neobanks concept, let’s now understand how it is different from digital banks and traditional banks.

Digital banks:

A digital bank is a mobile version of traditional banks. Traditional banks function offline and have a physical presence, whereas digital banks are the digitally operated traditional banks.

They are extensions of traditional banks helping users connect with the branch without visiting it.

However, both neobank apps and digital bank apps operate to provide online banking services to customers. Here is a table that highlights the difference.

Why Prefer Neobanks?

Neobanks are constantly attracting younger generations making financial services more accessible and convenient for use. The quick and hassle-free services are much appreciated by the new generation and to our surprise there are nearly 146.42 million neobank users already. It is expected that this number might cross 386.3 million by 2028.

Popular companies such as Revolut and Wise have already launched their mobile apps reaching millions. Revolut has nearly 25.5 million consumers worldwide, and Wise has nearly 16 million users, helping them generate a wealth of money for their business.

By adopting the mobile-first approach, you too can put yourself at the forefront of the fintech industry and capture benefits.

How To Monetize Using Neobank Apps?

Below are the five common ways to make money using Neobank apps.

Interchange-led model:

In this model, the merchants pay an interchange fee against clients using their cards using the app. Many neobanks also support affiliate marketing or give cashback rewards while using this model.

Credit-led model:

In the credit-led model, neobanks provide a credit card before assigning a bank account. With these credit cards, users receive interest and fees.

Ecosystem-led model:

Neobanks can create an entire setup that comprehensively solves all the issues of the customers. It can include a budgeting tool, interest checker, investment options, and monetizing using the same.

Product extensions model:

With this model, neobanks can include a broader range of services such as insurance, loans, investment strategy, etc. Access to these services is usually kept limited and monetized.

All of these inclusions, be it in features or operations can help neobank apps attract new customers.

Also Read:- How to Build a P2P Payment App: A Complete Guide

What Are The Most Demanding Neobank App Features?

The next-gen neobank apps need to have innovative features to attract young and new audiences. However, this has to be achieved creatively and intuitively. Here are the core features that you should include in the Neobank apps.

| Features | Functionality |

| Secure transaction and data storage | Ensures end-to-end encryption, multi-factor authentication, and AI-driven fraud detection to protect financial transactions and sensitive customer data while ensuring regulatory compliance. |

| Account Opening | Enables fast, digital onboarding with identity verification, KYC compliance, and biometric authentication, ensuring a frictionless and secure user experience. |

| Biometric security | It enhances authentication with fingerprint, facial, and voice recognition, ensuring secure, frictionless access while preventing fraud and unauthorized access. |

| Multiple payment options | Allows seamless transactions with support for cards, UPI, digital wallets, bank transfers, and cryptocurrency, ensuring convenience and flexibility for users. |

| Push notification | Provides real-time alerts for transactions, security updates, and account activities, ensuring users stay informed and secure. |

| Financial operations | Streamlines transactions, fund management, and compliance with automation, real-time analytics, and secure processing for seamless banking |

| Payment QR code | Enables quick and secure transactions by allowing users to scan and pay instantly using their neo-banking app. |

| Personalization using AI | Enhances user experience with AI-driven insights, customized financial recommendations, and tailored banking services. |

| Financial dashboards | Provides real-time insights, expense tracking, and analytics, empowering users to manage their finances efficiently. |

| Cross-country payment | Enable fast, secure, and cost-effective international transactions with multi-currency support and real-time exchange rates |

| Budgeting tools | Help users track expenses, set savings goals, and manage finances with AI-powered insights and real-time analytics. |

| eWallets | Offer secure, fast, and convenient digital payments, enabling users to store, transfer, and manage funds seamlessly. |

| Gamification | Enhances user engagement with rewards, challenges, and interactive financial goals, making banking more engaging and motivating. |

What Are The Legal Requirements For a Neobank App Development?

Neobanks need to be strictly regulated, violation of any rule might just lead to some big financial thefts/crimes. This is why strict adherence to various below-mentioned licenses is necessary. Here are a few things that you need to take care of during app development.

Full banking license:

To call your neo-bank a bank, you must have a banking license. These are usually issued by central banks to perform various banking operations, such as taking deposits, loan issuance, money lending, etc.

If you are operating in the US, you need to get license approval from the Fed and in Europe from the ECB. however, obtaining these licenses can be time-consuming, costly, and complicated.

Fintech license:

The fintech industry is continuously evolving, making it a necessity for the fintech industry to come up with new regulated licenses. With a fintech license apps can provide banking services but in a restricted manner. For example, apps can not transact beyond a certain threshold.

What Are The Current Neo-bank Market Trends:

If you are developing a neo-bank app from scratch, you need to be aware of the current trends that you can integrate into the app.

AI/ML:

To enhance the experience and bring out the best possible browsing experience, integrate AI/ML into the Neobank app. You can design virtual consultants, provide customized recommendations, and streamline operations using these advanced technologies.

Internet Of Things:

Use IoT and streamline payment processing and revenue tracking.

Security enhancements:

Protecting users’ data should be the top priority thing to achieve with neobanks. Allow users to freeze or block their account if they feel suspicious about any online activity.

Transparency:

Keep the Neobank users informed about their account activity in real-time. Let them access their account’s transaction history or make financial calculations if needed.

What Is The Cost Of Neobank App Development?

Developing a Neobank application can cost you around $30,000 to $60,000. However, this is just an estimate and the actual fintech app development cost may vary depending on your project specificities, like, complexity of the project, UI/UX design, features integration, third-party API integration, cost of hiring experts, location of app development partner, etc.

To get an exact cost of Neobank app development, feel free to get in touch with us.

What Are Some Popular Examples of Neobank Apps?

Chime as of now offers unparalleled competition by acquiring nearly 12 million customers. The next on the list of popular neobank apps is Monzo, which offers a wide variety of features and user-friendy operations.

Wise, also previously known as TransferWise facilitates access to Wise Borderless Account and allows to manage finances on the go.

N26 is also a great app that provides a range of functionalities to the users to manage cross-functional transactions.

Revolut offers a complete solution to all monetary issues.

Let’s Launch Your Neo Bank App With IT Path Solutions Today!

Digital banking software development is not as easy as you might think. You need expert experience to successfully launch your application. We, at IT Path Solutions, follow a comprehensive app development process that helps us achieve neobank app development on time.

Do you also want to achieve a promising result with app development? Get in touch with us and let us help you navigate through your business plan!

Keyur Patel

Co-Founder

Keyur Patel is the director at IT Path Solutions, where he helps businesses develop scalable applications. With his extensive experience and visionary approach, he leads the team to create futuristic solutions. Keyur Patel has exceptional leadership skills and technical expertise in Node.js, .Net, React.js, AI/ML, and PHP frameworks. His dedication to driving digital transformation makes him an invaluable asset to the company.

Get in Touch

Search

Blog Categories