Home

»Blog Insights

»Fintech App Development Cost: Factors and Features Affecting the Cost of App Development

Fintech App Development Cost: Factors and Features Affecting the Cost of App Development

Keyur Patel

September 12, 2025

7 min

Financial app development budgeting is crucial as it is the deciding factor in determining the success of the project. If you ask us what the cost breakdown of fintech app development is, we answer that it ranges from $30,000 to $70,000 or more. The “more” here refers to many intricate factors that cause app development costs to fluctuate.

In this blog, we have taken help from our Fintech app development expert Mr. Bhavik Shah to give you a detailed cost breakdown. This article will cover various types of fintech apps, the key factors affecting development costs, and how different features and requirements can impact your budget.

So let’s begin

What is a Fintech App?

A fintech app is a technology-integrated mobile app that functions as a go-to bank for customers. There are a variety of financial apps that help individuals manage various activities such as managing their bank accounts, tracking deposits, managing credit scores, money lending, cryptocurrency management, etc.

These financial apps give individuals a chance to organize their finances effectively and conveniently at their fingertips.

The Rise of The Digital Fintech Apps:

Do you remember the time when everything in the world came to a standstill, yet the need for transactions persisted? Yes, COVID-19 was the year that revolutionized the financial service industry.

Faced with unprecedented challenges, consumers were forced to change their behaviors from the traditional style of banking to a digital way of handling finances. And ever since then, there has been no looking back in how we manage our finances.

As per Mordor Intelligence, the global fintech market is expected to cross $608.35 billion by 2029.

Also, 65% of the US population and 90% of Chinese confirm using one of the digital banking solutions.

The world is slowly transcending towards a cashless era, and it is the right time to make the quick swift leap to fintech app development.

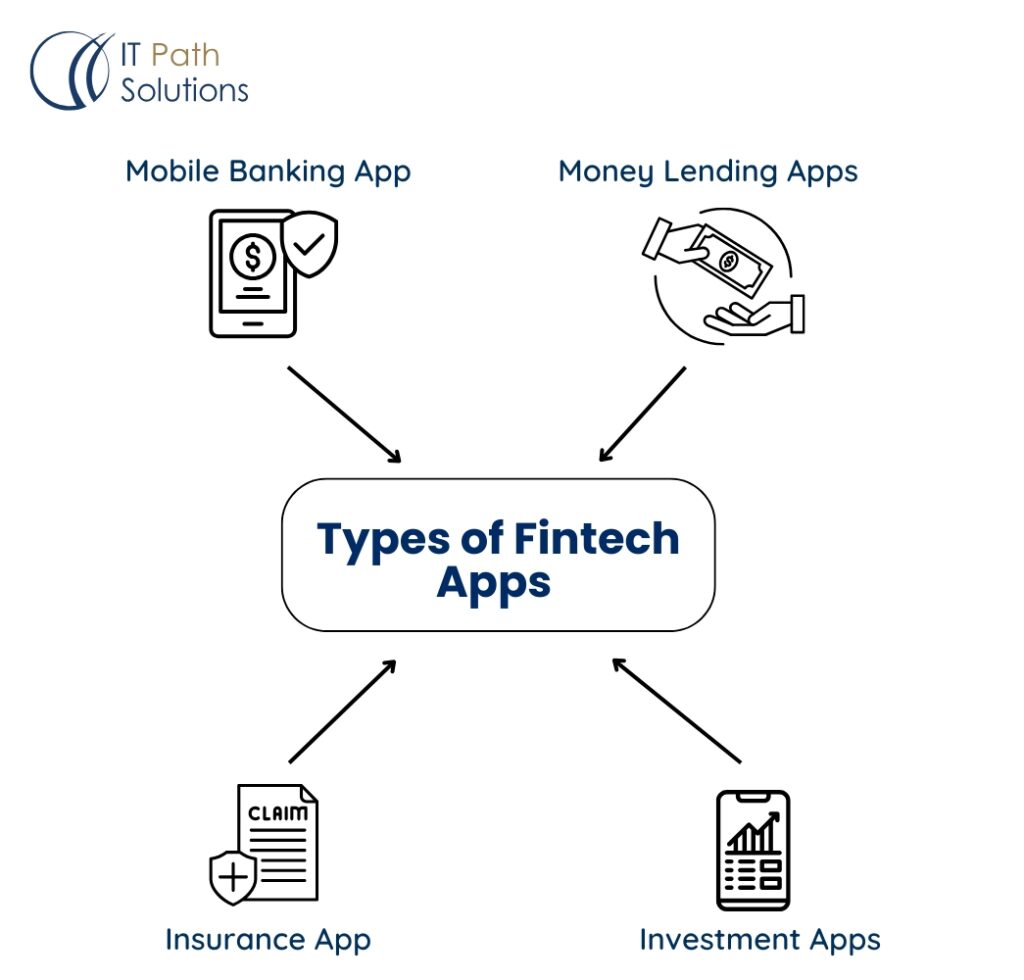

Types of Fintech Apps That You Can Develop:

Here are some common fintech app types that you can plan to develop for the coming years.

-

Mobile banking App:

A financial app that manages accounts, schedules payments, transfers funds, pays bills, etc. Some of the popular mobile banking app examples are Monobank, Revolut, and Chime.

-

Money Lending Apps:

Money lending apps connect consumers who need money to lenders. The repayment scenario for money lending can have various conditions that you can decide internally, by studying your competitors. A few popular money-lending apps are Dave, Brigit, and ZestFinance.

-

Insurance App:

Insurtech apps help customers claim their insurance digitally and effortlessly. Some popular examples in this segment are Lemonade, Oscar Health, and Centraal Beheer Achmea.

-

Investment Apps:

Investment apps facilitate the buying and selling of stocks using mobile apps. Popular examples of investment apps are: Acorns, Robinhood, and CNBC.

If we break down the app development cost based on the types of fintech apps, it goes like this.

| App Type | Development cost |

| Mobile banking app | $20,000-$45,000 |

| Investment app | $40,000-$80,000 |

| Insurance App | $10,000-$25,000 |

| Money Lending apps | $25,000-$75,000 |

| Crypto management app | $50,000-$1,50,000 |

As you can observe there is a lot of cost variation involved with different types of applications. This is because the complexity and features are different for each one of them. So what factors affect the cost of building a fintech application? Let’s discuss.

Do you have a fintech app idea that you want help with? Contact us!

Factors Affecting The Cost Of Fintech App Development:

There are several factors that influence the cost of fintech application development. Here is an explanation for that.

Application complexity:

The more sophisticated features you plan to integrate into your app, the higher the fintech app development cost is! Basic features such as user authentication, transaction, expense tracking, payment gateway integration, etc are relatively straightforward and require less time and budget to develop.

Complex features such as crypto-exchange, AI integration, blockchain, real-time stock rates, etc increase development complexity, leading to a higher cost.

Interactive UI/UX:

The underlying purpose of financial app design is simplicity in UI. To ensure the best of the best user experience, one needs to design a seamless app design that doesn’t look complex and suggests easy navigation.

A well-designed app with sufficient white space, font, and simple vocabulary can exemplify the user experience.

But, all of this brainstorming comes with a cost, right?

To summarise, the more sleek and sophisticated the design, the higher the price!

Platform compatibility:

Android, iOS, or both? It goes without saying that the development cost for a single platform is quite less than the development cost for multiple platforms. This is because a single platform involves development on a single code base, whereas app development across iOS and Android requires the creation of different versions of code or the usage of cross-platform development tools.

Hence, the selection of a platform adds to the final cost of fintech app development.

Location of the development partner:

The location of the development company that you are partnering with plays a crucial role in affecting the cost of application development. You will probably need a team of around 6-7 specialists, to develop a fintech app.

Now, hiring rates differ from country to country. Here is the list that highlights the hourly rates of developers from different countries.

| Location | Hourly Rates of Developers |

| Europe | $25-$35 |

| India | $15-$30 |

| Australia | $25-$45 |

| Africa | $20-$35 |

| Canada | $25-$45 |

| UK | $25-$35 |

| America | $30-$45 |

The table clearly reflects that hiring rates in India are comparatively lower than hiring rates in other countries. So, are you ready to hire developers from India and save some money for your project?

Security Measures:

Financial apps manage a huge chunk of sensitive user data. This is why it requires following all the standard security protocols such as SSL encryption, biometric authentication, face detection, data protection, end-to-end encryption, etc to ensure the protection of users’ sensitive data.

Basic security feature integration such as user authentication, and data encryption might cost you less than advanced security feature integration such as multi-factor authentication, biometric logins, etc, which needs expert guidance.

App Maintenance:

The successful implementation of a financial application relies heavily on maintenance. You need to upkeep and update the financial apps regularly to ensure the application is running smoothly for the users.

Keeping the application up-to-date requires some investment and adds to the overall cost of app development.

Compliance Requirements:

Fintech applications require compliance with regulatory standards. If the financial application is operating in the UK, it needs to comply with GDPR rules, PSD2, PCI DSS, etc, which adds to the cost of fintech app development.

If the fintech app operates in the US, it needs to comply with OCC, CFPB, SEC, and other state-level regulations.

You can read more about the regulations of different countries in this blog.

Tools and Technology:

The technology stack you select highly influences the cost of fintech app development. Fintech application development uses React Native, PHP, and Flutter for app development. However, more advanced technologies such as Python, Node.js, AI, or Blockchain can also be integrated into the application.

The integration of the advanced technologies adds to the cost of fintech application development.

How Long Does It Take To Build a Fintech App?

Fintech app development can take longer than expected as a lot of intricacies are required to be looked after. If we are to break the timeline requirements, it goes like this,

- Basic features integration and app development would take up to 6 months.

- Advanced and complex feature integration will take nearly 12 months and more.

This is a very subjective question and the timeframes may vary depending upon your requirements.

Closing Thoughts:

Fintech app development cost covers a lot under its umbrella. And we hope we have been able to highlight every aspect that affects the cost of app development. If you still have any further questions or want to discuss your app development idea, you can get in touch with our fintech experts. They would be happy to help!

Keyur Patel

Co-Founder

Keyur Patel is the director at IT Path Solutions, where he helps businesses develop scalable applications. With his extensive experience and visionary approach, he leads the team to create futuristic solutions. Keyur Patel has exceptional leadership skills and technical expertise in Node.js, .Net, React.js, AI/ML, and PHP frameworks. His dedication to driving digital transformation makes him an invaluable asset to the company.

Related Blog Posts

Essential Features every Scalable Mobile App must have in 2026

Let’s start with a situation most product leaders recognize. It is early 2026. Your mobile app has finally found traction. Daily active users are climbing. Marketing campaigns are working. Investors are optimistic. Then something breaks. Screens take too long to load. This happens during peak hours. A payment fails silently. A security audit flags basic… Essential Features every Scalable Mobile App must have in 2026

How to choose the right Mobile App Development Partner for your Business Growth

Let’s start with a story that haunts the IT industry. A well-funded logistics company decided they needed a custom mobile app to track their fleet. They did what most companies do: they Googled mobile app development company, sent out a generic Request for Proposal (RFP) to the top five results, and picked the one with… How to choose the right Mobile App Development Partner for your Business Growth

November 1st Is NOT The Real Deadline For Android 15. Here’s What You’re Missing

Imagine waking up one morning and discovering your Android app is invisible to millions of users on the Google Play Store. No installs, no updates, no revenue. Sounds terrifying, right? It is not a science fiction plot; it is the looming reality many businesses and developers could face in November 2025 if they neglect the… November 1st Is NOT The Real Deadline For Android 15. Here’s What You’re Missing